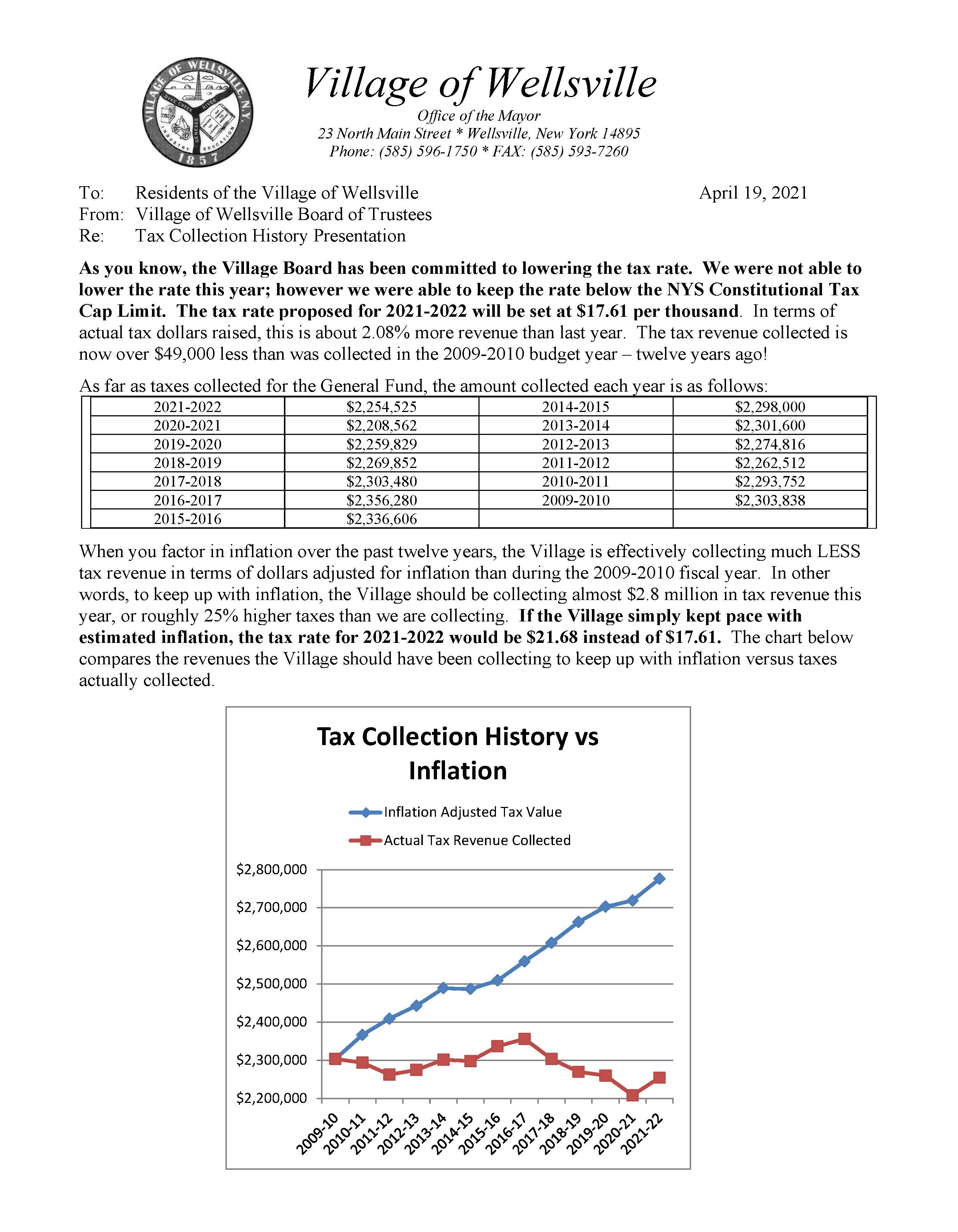

Mayor Randy Shayler’s letter to the residents of the village announces a slight tax increase for the upcoming budget. While admitting that short term setback, the Mayor notes real progress in the long term goal of scaling back village spending and keeping property taxes in check. Read the recent letter from Shayler was that submitted to residents:

* = Inflation amounts are through March 2021.

Each year it has been the Village Board’s goal to lower the tax rate while still providing the same range of services. Although we were not able to do so this year we were still able to keep rates low and below the NYS Tax Cap Limit for the residents of the Village of Wellsville. From public safety to street maintenance, Village surveys indicate every service is valued by residents so the board works to create a budget that provides those valued services efficiently.

Sincerely, Randy M. Shayler, Mayor

Treasurer’s Report

- This is the fifth budget presentation under Mayor Shayler’s tenure. The Deputy Mayor is Jeff Monroe. Trustees Ed Fahs, Mike Roeske continue to serve village residents and we welcome the addition of Trustee Gary Pearson to the Village Board. It is the board’s duty to develop policies and enact ordinances and resolutions to ensure the health, safety and welfare of Wellsville residents.

- One of their most important responsibilities is to adopt an annual budget that provides those services. As part of this process, the Mayor and Board of Trustees establish the tax levy and make arrangements for that levy to be collected. The board continues its determination to look at the budget critically and reduce the tax rate. This commitment is reflected in the tentative budget with the new tax rate only being increased by 1.50% or$0.26 from last year. The rate will increase from $17.34 in 2020-2021 to $17.61 in 2021-2022, which is still under the Constitutional Tax Cap Limit allowed by New York State. The board believes, if possible, village government should constrain itself during challenging times which they have continued to do this year.

- This 2021-2022 Tentative Budget Public Presentation has been prepared in conjunction with the Finance Committee and approved by the board. As always, village management has assisted in preparing the estimates that become the municipal budget. COVID-19 has made this budget quite challenging with a number of uncertainties reflected in both the revenue streams and expenses. Four of the five funds are in balance, with the exception being the electric fund. Additional appropriations were utilized in both the Water and Refuse funds from the unassigned fund balances. In order to keep from increasing both water and refuse rates, the Board has chosen to utilize appropriations from the unassigned fund balances in those Funds. As usual, for some needs, we are using reserves to offset planned purchases and capital projects per the annually updated Capital Plan.

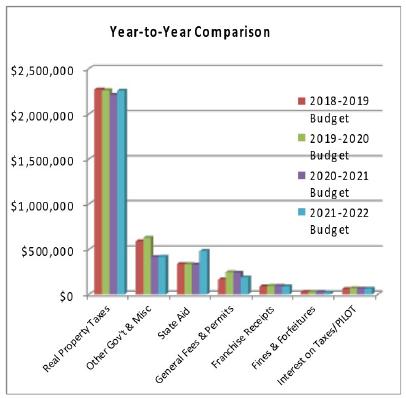

- The taxable assessed value increased this year from $127,368,041 to $128,048,709. The budgeted property tax levy for 2021-22 has been set at $2,254,525, which is $45,963 higher than last year’s tax levy of $2,208,562. This tax levy is still lower than it has been in the last twelve years – in 2009-10the levy was $2,303,838!The Village tax cap for 2021-22 is 1.78% and the adjusted allowable tax levy limit is $2,289,589 meaning the proposed $17.61 tax rate is $.27 under the rate allowed by law of $17.88.

- In other words, the Village tax rate is 1.5% lower than allowed under the tax cap, or $35,020 lower than property tax revenue the Village was authorized to collect this year. We annually provide some information regarding tax exempt properties: The total assessed valuation that is exempt from Village taxation is $52,447,306 of the assessed total of $180,496,015, leaving the $128,048,709 taxable valuation. The tax exempt total was down slightly from $52,549,066 with the tax exempt percentage of the total Village valuation declining slightly with the overall assessment becoming 29.1%.The total General Fund revenues are estimated at $3,512,260.

- This year we expect to use $106,000 from reserves to purchase equipment and fund projects; the overall budget is roughly $133,000 higher than last year. Total General Fund expenditures are likewise projected to be $3,512,260. Expenditures in most categories are similar or slightly lower than what was budgeted for 2020-2021. The Fire Department budget has increased by $15,500 to allow for capital planning. Another area of increase is reflected in the Pension expense which is projected to see an overall increase of 29% in the 2021-2022 Fiscal Year.

The total Water Fund revenues are estimated to be lower by $112,000 from last year’s budget (2020-2021) at $959,000 compared to $846,650 in this budget year (2021-2022). The Water Fund Fees are expected to remain unchanged with unappropriated funds being used to balance the fund. Sewer revenues are projected to be higher at $749,170 up from $652,000. Sewer fees will increase by 15% in order to fund the large capital project which is expected to begin later this year.

Refuse Fund revenues are projected to be $360,700 which is similar to last year. The fees will remain the same with $25,285 utilized in unrestricted appropriated funds to balance the fund.

We have updated our long-term capital planning as part of the budget process as usual. Even though not yet required by NYS law, we believe long-term capital planning is very important to our budgeting process and these working documents help identify when major capital needs will be required. One of the many impacts of the Property Tax Levy Cap Law is that adding debt without exceeding the cap becomes very difficult. It requires better timing and/or a commitment to build reserves and self-finance capital needs using those reserves.

These long-term planning documents include: a Fund Balance Policy and Reserve Balances spreadsheet, which outline the allocation of funds in light of new accounting rules and to ensure the Village maintains adequate fund balances and reserves; a Strategic Financial Plan that develops longer-term strategies so that the Village is able to provide the service mix desired by the community with the lowest possible tax levy and fees (while maintaining a solid financial foundation); and a Capital Purchase Plan spreadsheet that looks five to eight years out in the future to identify and plan for capital needs.

The Mayor and Board of Trustees would like to thank the Village staff for their participation in this year’s process and their acknowledgement of the budget challenges and uncertainties we continue to face in the 2021-22 budget year. Without their collaborative efforts the Village of Wellsville would not have been able to keep the property tax rate below the tax cap rate for the Village of Wellsville residents for the 2021-22 Fiscal Year.

Sincerely, Melissa Mullen

Village Treasurer