HNI to Close Historic Gunlocke Factory in Upstate New York

by Rob Kirkbride, OfficeInsight.com

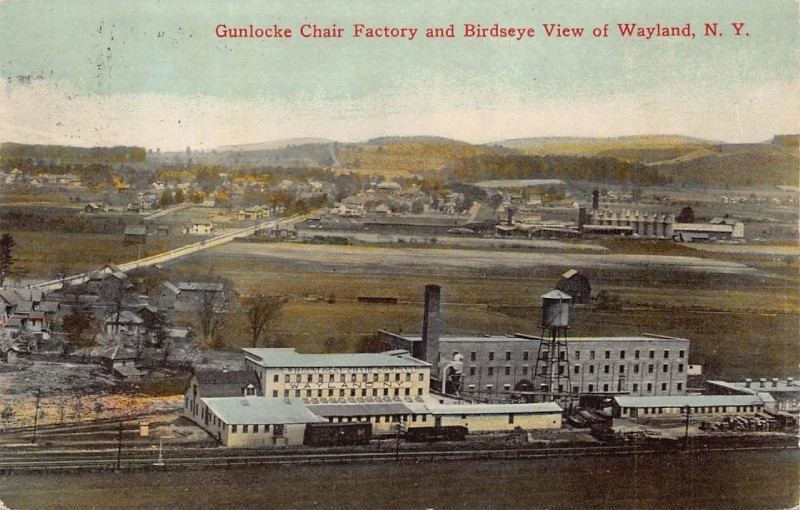

HNI Corp. announced today that it is closing its historic Gunlocke plant in Wayland, N.Y. next year, a facility nestled in the rolling hills of upstate New York that has made wood furniture for the Oval Office, high power board rooms and offices around the world for 124 years.

In a statement, the company announced that it will consolidate production into its other North American facilities over the coming year. HNI said it expects the consolidation to improve productivity and strengthen operations while meeting capacity requirements and creating enhanced experiences for its customers and trade partners.

All products currently produced at the Wayland facility will shift to existing facilities across the HNI manufacturing network, with no anticipated changes in the product portfolio. The Gunlocke brand, which HNI acquired in 1989, its products, and its standards of quality, craftsmanship and service will continue to be an important part of the HNI portfolio, according to the company.

“Closing the facility is a difficult decision given the hard work and expertise of the Wayland team. We are grateful for our Wayland members’ dedication and craftsmanship, and we are committed to providing support and resources throughout the transition. This is a strategic change that aligns with our continued network optimization journey. We are announcing the consolidation a year in advance as part of our commitment to ensuring a smooth transition for our members and our customers,” said Brandon Bullock, HNI’s chief operating officer.

There are few plants that have the history of Gunlocke in Wayland. Its furniture is imbued with the spirit of the company and the generations of workers who have made it. A walk through the plant feels like a step back in time, which is, one could argue, part of the problem. Machinery nearly as old as the company itself can be found in the plant and for HNI, it simply became too costly to operate, especially with the addition of Kimball, which has more modern woodworking equipment and a centralized Midwest location and partially enabled the decision to close the facility. HNI estimates the consolidation will save approximately $7.5 million to $8 million annually once fully mature.

“In the two years since HNI’s acquisition of Kimball International, our integration continues to be highly complementary from a product, market, and cultural perspective,” according to the company and no way reflects negatively on the Wayland team’s hard work and dedication. “Our teams have made meaningful integrations that have allowed us to accelerate synergies across the network. These accomplishments highlight the dedication, collaboration, and hard work of our members.”

The plant closure, which affects about 135 workers, will be a huge blow to the small community of about 2,000 that has embraced the company since William H. Gunlocke founded it in 1902.

“We are extremely grateful for the contributions of these members over the years and will support our members through separation pay and other resources. Job opportunities in other areas of the organization may also be available. We are committed to making this a smooth transition for our Wayland members,” according to HNI.

HNI finalized the acquisition of Steelcase a few weeks ago and said: “This operational decision does not affect our other brands. We also do not expect any impact on our lead times, ordering process or quality as part of this transition. We regularly evaluate our operations to ensure we have the right capabilities in the right locations to meet our customers’ needs efficiently and effectively. This is how HNI — including Steelcase and Kimball International — have always operated. We remain committed to being transparent and communicative with our members, communities, and other stakeholders.”

Gunlocke and four other wood furniture experts built the company in a vacant factory in Wayland where they established the W. H. Gunlocke Chair Company, which at the time specialized in seating for homes, libraries and lounges. When a new wing was added to the factory in the 1970s, the company expanded its line to include tables, desks, credenzas and book cases. Howard Gunlocke became president upon the death of his father in 1937. He brought mass manufacturing into the factory, and he made a showroom with product samples for customer viewing. The first traveling showroom, set up in the back of a trailer truck, was also one of Howard’s ideas.

READ THE FULL ARTICLE HERE FROM OfficeInsight.com

HNI issued this statement to shareholders on there website:

HNI Corporation Announces Plant Consolidation

On January 8, 2026 the HNI Corporation, owner of Gunlocke manufactuaring in Wayland NY, made a sad announcement. After 103 years in operation, the plant will be closed next year. Generations have made furniture and furnishings in the facility that

MUSCATINE, Iowa–(BUSINESS WIRE)– HNI Corporation (NYSE: HNI) announced today it will exit its Wayland, New York, manufacturing facility in 2027. The Corporation intends to consolidate production into its other North American facilities over the coming year. HNI expects the consolidation to improve productivity and strengthen operations while meeting capacity requirements and creating enhanced experiences for its customers and trade partners. All products currently produced at the Wayland facility will shift to existing facilities across the HNI manufacturing network, with no anticipated changes in the product portfolio. The Gunlocke brand, its products, and its standards of quality, craftsmanship, and service will continue to be an important part of the HNI portfolio.

“Closing the facility is a difficult decision given the hard work and expertise of the Wayland team. We are grateful for our Wayland members’ dedication and craftsmanship, and we are committed to providing support and resources throughout the transition. This is a strategic change that aligns with our continued network optimization journey. We are announcing the consolidation a year in advance as part of our commitment to ensuring a smooth transition for our members and our customers,” said Brandon Bullock, HNI’s Chief Operating Officer.

Estimated Financial Impacts(On HNI Corp investors)

- Cost savings. HNI estimates the consolidation will save approximately $7.5 to $8.0 million annually once fully mature. The consolidation of Wayland production into HNI’s manufacturing centers of excellence was partially enabled by the strategic integration of Kimball International (KII). Total cost synergies associated with the integration of KII are now anticipated to total $68 million by end of 2028, including ongoing initiatives in procurement and the maturation of previously announced network optimization projects.

- Resulting charges. HNI anticipates charges resulting from the consolidation will impact pre-tax earnings by an estimated $14.9 million in 2026 and 2027, including $5.7 million of non-cash charges.